BEIJING, CHINA – Media OutReach – 14 August 2020 – Driven by the Government’s FinTech development plan and innovation strategy, China is leading the way in business FinTech usage across the region, according to a survey of business FinTech usage by CPA Australia, one of the world’s largest accounting bodies.

The survey found that 80 per cent of respondents from China reported that their businesses had used at least one FinTech product or service in the past twelve months, which is the highest result of the surveyed markets. Further, Chinese businesses were the most likely to maintain or increase their usage of mobile payments/digital wallets, robo-advisory/chatbots, wealth management technology and FinTech lending in the past twelve months.

Tony Chan, Deputy President of CPA Australia South China Committee says that the fast-growing business FinTech usage in China is boosted by the development of emerging technologies and changing consumer behaviour.

“Supported by a number of favourable Government policies, including financial and tax incentives, such as the 175 per cent super deduction for eligible R&D expenditure and greater funding for AI development by local governments, Chinese businesses are more inclined to utilise FinTech compared with businesses from the other surveyed markets.”

“Another factor that has led to a boost in business FinTech usage in China is changing consumer behaviour. Chinese millennials, who are digital natives, are a major force in the consumer market, and this has further spurred Chinese businesses to adopt FinTech.”

The survey findings also indicate there is a clear link between the use of FinTech and business growth. It found that 74 per cent of Chinese businesses that were more profitable in 2019 either maintained or increased their usage of mobile payments or digital wallets in the past 12 months, and 54 per cent of Chinese businesses that were more profitable in 2019 either maintained or increased their usage of robo-advisory/chatbots.

“FinTech will be an engine for business growth and we believe China’s leadership in FinTech usage amongst businesses will continue.” Mr Chan comments.

84 per cent of surveyed respondents from China believe their businesses will use at least one FinTech product or service in the next 12 months, according to the survey.

However, the impact of the rapid growth of FinTech usage in Chinese businesses has also created challenges. According to the survey, respondents from China were most likely to select cybersecurity concerns (41 per cent) and shortage of FinTech talent (37 per cent) as the key barriers to business FinTech adoption.

“Amongst the surveyed markets, we note that businesses in China were most likely to choose a shortage of FinTech talent as one of their key challenges to FinTech adoption, which is a consequence of growing business usage of FinTech in China.

“To meet this challenge, we would welcome more cross-disciplinary FinTech degree programs and we suggest that businesses, research institutions and universities in China collaborate in developing new talent development plans to cultivate, recruit and retain FinTech talent,” Mr Chan says.

For more information on CPA Australia’s Business FinTech Usage Survey:

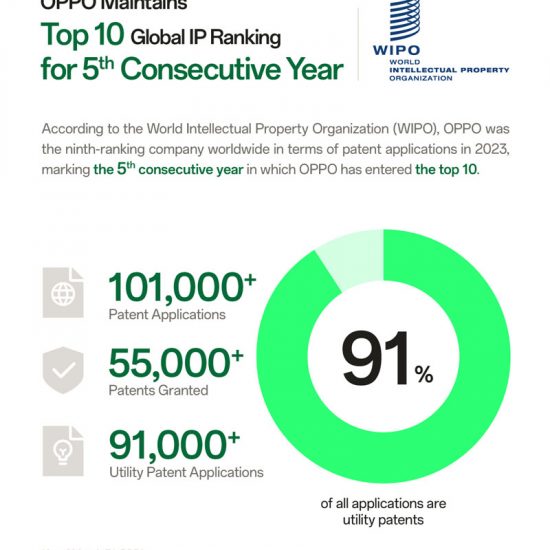

CPA Australia’s Business FinTech Usage Survey – Preliminary, Mainland China results

CPA Australia’s Business FinTech Usage Survey — Infographic

About the survey

The survey was conducted by CPA Australia from 23 June to 14 July 2020. A total of 573 responses were received from accounting and finance professionals in Mainland China, Hong Kong, Singapore and Malaysia, with 158 respondents from Mainland China.

About CPA Australia

CPA Australia is one of the world’s largest accounting bodies with more than 166,000 members working in 100 countries and regions around the world, and with more than 25,000 members working in senior leadership positions. It has established a strong membership base of more than 19,000 in the Greater China region.