A prominent cryptocurrency hedge fund recently experienced a surprise investigation by Swiss authorities in connection with significant financial losses linked to the FTX trading platform. The unprecedented move by Swiss regulators raises questions about the regulatory environment surrounding crypto investments and the potential implications for other funds operating in the sector.

The hedge fund, known for its active involvement in the crypto market, reportedly faced the raid as part of a probe into substantial financial setbacks incurred through investments associated with FTX. Sources reveal that the losses were substantial, prompting regulatory scrutiny to ascertain the fund’s compliance with financial regulations and investor protection measures.

The Swiss authorities, renowned for their strict financial oversight, have not disclosed specific details about the ongoing investigation. However, industry experts speculate that the regulatory focus is on assessing risk management practices, due diligence, and compliance measures employed by the hedge fund in its crypto investments.

The incident has sent ripples through the cryptocurrency community, with market participants closely monitoring the developments and their potential impact on investor confidence. The connection to FTX, a major player in the crypto exchange landscape, adds a layer of complexity to the situation, raising concerns about the risk associated with trading platforms and their influence on the broader crypto market.

Investors in the hedge fund are naturally anxious about the repercussions of the Swiss raid and the subsequent investigation. The fund, which attracted substantial investments due to its crypto-focused strategy, may face increased scrutiny from existing and potential investors. The lack of detailed information about the nature of the losses and the regulatory concerns only adds to the uncertainty surrounding the fund’s future.

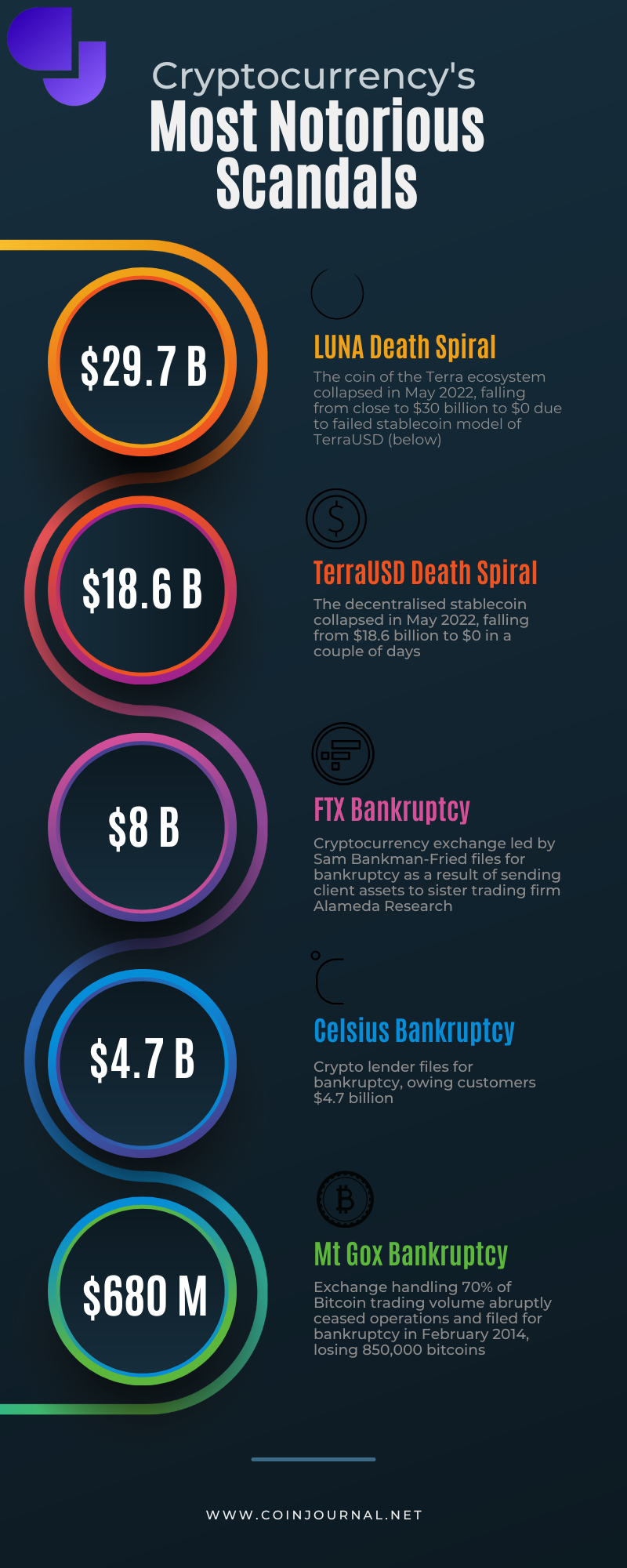

The FTX exchange, implicated in the hedge fund’s financial woes, has yet to officially comment on the situation. The exchange, known for its innovative products and services in the crypto derivatives market, may also face increased regulatory attention as a result of its association with the fund’s losses. The potential impact on FTX’s reputation and business operations remains uncertain as the investigation unfolds.

Cryptocurrency markets have been historically volatile, and incidents like these underscore the challenges faced by investors and regulatory bodies in navigating this rapidly evolving landscape. As the crypto sector continues to gain mainstream attention, regulators globally are grappling with the need to strike a balance between fostering innovation and safeguarding investors from potential risks.

The Swiss raid on the crypto hedge fund serves as a stark reminder of the regulatory uncertainties surrounding digital assets and the urgency for comprehensive frameworks to govern crypto-related activities. It remains to be seen how this incident will influence regulatory approaches in other jurisdictions and whether it will lead to more stringent oversight of crypto hedge funds and exchanges globally.

__________________________________

This article first appeared on The WIRE and is brought to you by Hyphen Digital Network

(The content powered by our AI models is produced through sophisticated algorithms, and while we strive for accuracy, it may occasionally contain a few minor issues. We appreciate your understanding that AI-generated content is an evolving technology, and we encourage users to provide feedback if any discrepancies are identified. As this feature is currently in beta testing, your insights play a crucial role in enhancing the overall quality and reliability of our service. We thank you for your collaboration and understanding as we work towards delivering an increasingly refined and accurate user experience.)