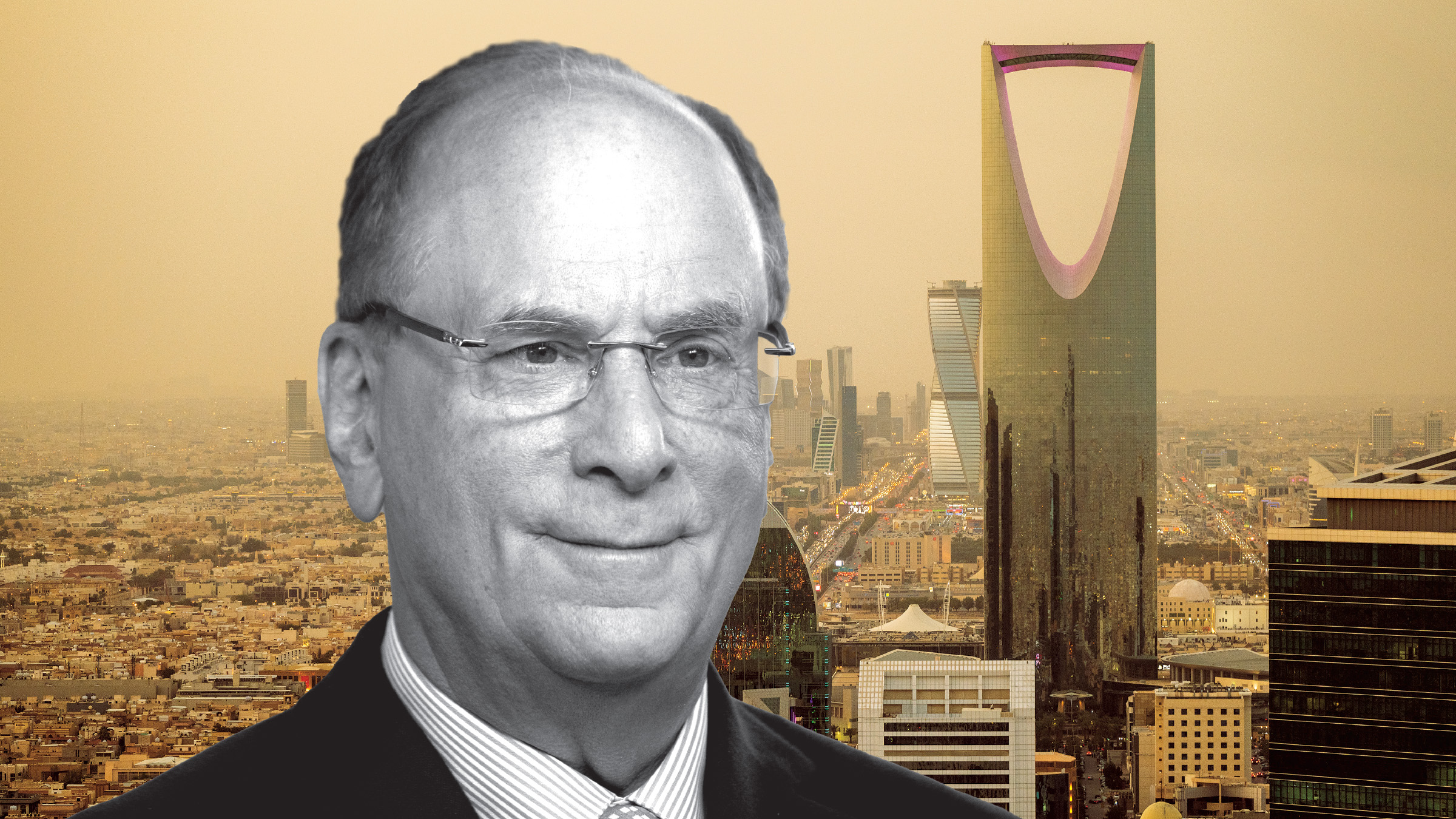

BlackRock, a leading global asset management firm, has announced a strategic partnership with Saudi Arabia to enhance the kingdom’s property finance sector. This collaboration aims to create a robust real estate finance framework, supporting both residential and commercial property development across the country.

The agreement was formalized through BlackRock’s dedicated real estate investment team, which will work closely with Saudi entities to leverage their expertise and capital in the property finance market. This partnership reflects a significant commitment from BlackRock to expand its presence in the Middle East and capitalize on the region’s growing real estate opportunities.

Saudi Arabia’s Vision 2030, a comprehensive reform plan aimed at diversifying the kingdom’s economy beyond oil dependence, plays a central role in this initiative. The Vision 2030 framework includes substantial investments in infrastructure and urban development, creating a fertile ground for property finance advancements. BlackRock’s involvement is expected to accelerate the development of new financial products and investment vehicles tailored to the evolving needs of the Saudi property market.

The new partnership will focus on several key areas. Firstly, it will develop innovative financial solutions to support large-scale real estate projects, including residential complexes, commercial spaces, and mixed-use developments. By introducing advanced investment mechanisms, the collaboration aims to attract both domestic and international investors, enhancing liquidity and market depth.

Additionally, BlackRock and its Saudi partners will work on improving the regulatory and financial environment for real estate investments. This includes streamlining processes, enhancing transparency, and implementing best practices that align with global standards. The goal is to make the Saudi property market more attractive and accessible to a broader range of investors.

Experts highlight that this venture aligns with broader trends in the global real estate finance sector, where major investment firms are increasingly targeting emerging markets with high growth potential. Saudi Arabia’s strategic location, economic reforms, and ambitious development plans position it as a key player in the region’s property finance landscape.

This partnership also comes at a time when Saudi Arabia is focusing on expanding its non-oil revenue sources. By fostering a dynamic real estate sector, the kingdom aims to generate new income streams and enhance its economic resilience. BlackRock’s entry into the Saudi market is viewed as a significant endorsement of the kingdom’s economic policies and investment climate.

The collaboration underscores BlackRock’s commitment to leveraging its global expertise and resources to support transformative projects in key markets. It also reflects the growing interest among international investors in Saudi Arabia’s economic potential and the opportunities presented by its expansive development projects.

Overall, the alliance between BlackRock and Saudi Arabia represents a pivotal development in the kingdom’s property finance sector. By combining BlackRock’s financial acumen with Saudi Arabia’s ambitious development goals, the partnership is poised to drive significant advancements in the real estate market, contributing to the broader objectives of Vision 2030.