The fate of billions of dollars in investments in Turkish bonds hangs in the balance as Moody’s Investors Service prepares to reveal whether it’s handing the country a second junk rating on its debt.

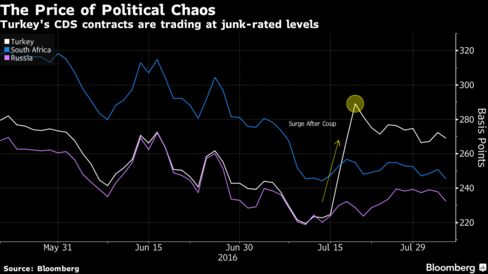

Moody’s, which put Turkey on review for a downgrade immediately after a failed military plot to oust the government last month, currently ranks the nation’s debt at Baa3, its lowest rung within investment grade. A rating review is scheduled for Friday and derivatives traders are already treating it as speculative, with the score implied by credit default swaps at Ba3, three steps into high-yield territory, according to Moody’s Analytics.

If it cuts, Moody’s will join S&P Global Ratings in assigning Turkey non-investment grade status, rendering its bonds ineligible for many international investors who are limited to holding low-risk assets. While JPMorgan Chase & Co. said a downgrade may drive forced selling of as much as $8.7 billion of Turkish bonds, even a decision to keep the rating unchanged will not assuage all investors if the outlook remains negative.

Below investors and analysts give their views on how Turkish markets will react to either outcome of the Moody’s review.

Scenario 1: Downgrade to Junk

* JPMorgan estimated $7.2 billion worth of Turkish sovereign bonds and $1.5 billion in corporate debt are at risk of forced selling in the event that the notes are removed from investment-grade indexes used by many investors as benchmarks for their portfolios.

Spreads between Turkey’s foreign-currency debt and Treasuries may widen as much as 50 basis points with yields on the country’s bonds climbing to 10 percent, said Viktor Szabo, a fund manager at Aberdeen Asset Management in London, who helps oversee about $10 billion in emerging-market debt. Yields on 10-year notes were 9.9 percent on Friday.

* On currency markets, Brown Brothers Harriman warned a downgrade may push the lira to a record low of 3.10 against the dollar, from 3.017 on Friday, according to Win Thin, an emerging-market strategist based in New York.

“A downgrade is long overdue, said Thin, whose calculations show Turkey at Ba2 on the Moody’s scale, two steps into junk. This puts it at an equivalent level to S&P’s assessment, following a one-step cut to BB on July 20 with a negative outlook.

Scenario 2: No Change

* Moody’s said it will leave the credit grade unchanged if it concludes the economy “can withstand the pressure arising from rising political risks by maintaining confidence and growth, advancing economic reforms and preventing a further weakening of its balance of payments and foreign exchange reserves.”

* If this happens, the lira may rise to 2.85 per dollar, or 2.95 per dollar if the Moody’s statement defers a decision to a later date, according to Tatha Ghose, a senior economist at Commerzbank AG in London. CDS spreads will probably fall to 245 basis points if the status is affirmed versus 261 basis points on five-year contracts on Friday.

* Dmitri Barinov, a money manager at Union Investment Privatfonds GmbH in Frankfurt who helps oversee $1.2 billion, predicts a 1 percent gain for the lira while yields on foreign-currency bonds have scope to fall 20 to 30 basis points.

“If they keep watch negative, that would still mean that possibility of a downgrade in the next three to six months remains above 50 percent,” he said. “The language of the statement will be important.”

* Aberdeen’s Szabo said the ratings company will probably “wait for the dust to settle,” before changing Turkey’s score, though this will not mean Turkey is out of the woods. “Moody’s won’t remove the negative outlook so the threat will not be gone,” he said.

Anders Faergemann, a portfolio manager at at PineBridge Investments in London agreed.

“Turkey will eventually be downgraded to junk amid the increased political risk and the potentially flawed relation with the European Union,” he said.-Bloomberg