Naver Pay is spearheading an initiative to introduce a South Korean won–pegged stablecoin, with Dunamu—the operator behind Upbit—providing technical and operational support, launching a bold push into blockchain-based payments.

The payment platform officially disclosed its intent to enter the won stablecoin space on 26 June. Today, Dunamu confirmed its support for the project, emphasising that Naver Pay will lead, while Dunamu ensures robust backend assistance. Detailed structures and issuance responsibilities remain under review pending regulatory approval.

Stablecoins, digital tokens pegged 1:1 to the Korean won, promise minimal price volatility. Such stability makes them suited for everyday transactions and value storage. Naver Pay aims to cultivate an ecosystem that includes a consortium of financial institutions, tech partners, and regulatory consultation to ensure comprehensive infrastructure, covering issuance, redemption, reserves, wallet services, custody, and integration with existing payment rails.

This partnership coincides with broader momentum in the stablecoin arena. Eight major South Korean banks are collaborating through a joint venture to issue their own won-pegged token, targeting a launch by late 2025 or early 2026, contingent on regulatory clarity. Simultaneously, the Financial Supervisory Service supports these initiatives, signalling growing institutional endorsement.

On the legislative front, the National Assembly is considering the Framework Act on Digital Assets, which outlines provisions specific to KRW stablecoins. This follows advocacy within the Democratic Party for formal recognition of stablecoins as legitimate mediums of payment, underscoring their strategic importance in national finance.

Regulators like the Bank of Korea maintain a cautious stance toward non-bank stablecoin issuers, particularly fintech firms, reflecting concerns over financial stability and reserve transparency. At present, the central bank continues to advance its own CBDC project, but no formal decision has been made to integrate these private-sector stablecoins into national payment systems.

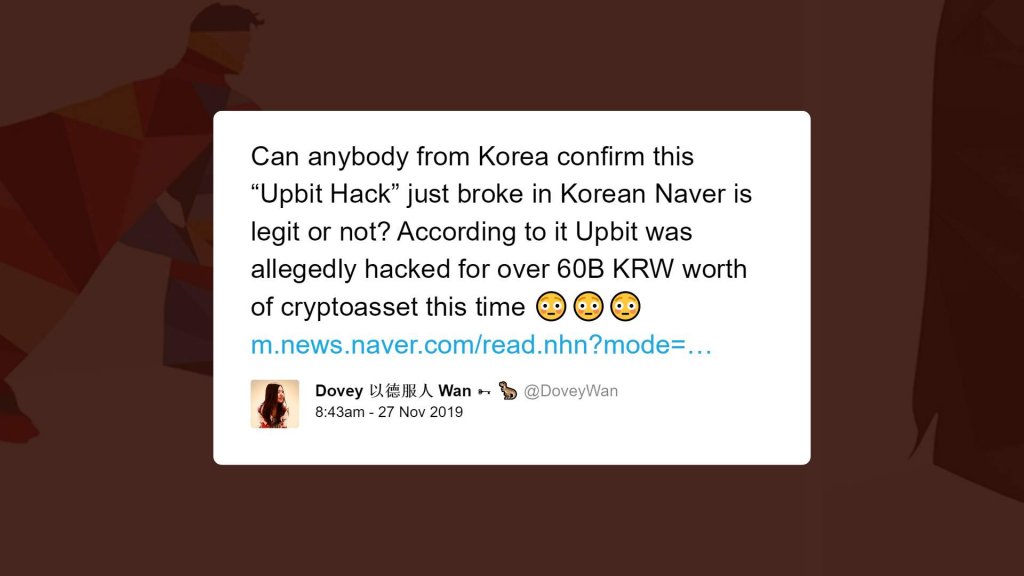

Naver Pay’s scale positions the platform as a potential game‑changer. With access to Naver’s vast user base—spanning search, e‑commerce, messaging, webtoons and fintech—the stablecoin could gain rapid consumer acceptance. Meanwhile, Dunamu brings its deep expertise in digital asset technology and compliance, as evidenced by Upbit’s leading position in South Korea’s exchange market.

International regulators are also focusing on stablecoin frameworks. In the US, the Senate passed the Genius Act on 17 June, indicating growing legislative momentum. Against this backdrop, South Korea’s regulators are keen to streamline stablecoin governance, striking a balance between innovation and consumer protection.

Arabian Post – Crypto News Network