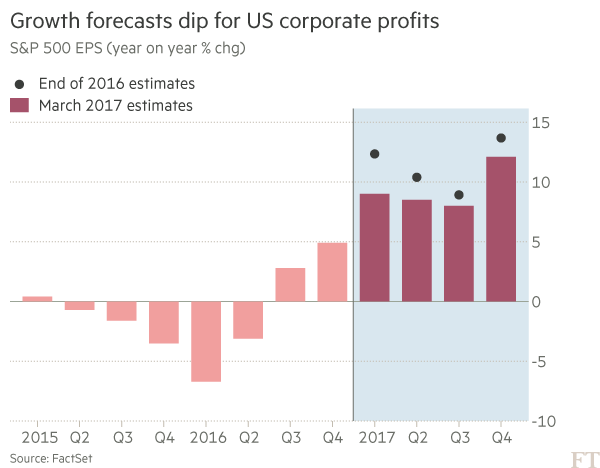

The US corporate profit outlook has dimmed in recent weeks, with analysts paring back their forecasts, in a fresh sign of the risks facing the Wall Street rally that has powered equities to record peaks.

Earnings for companies listed on the S&P 500 index, the main US stock barometer, are predicted to rise 9 per cent in the first quarter, FactSet data show. While the rate marks a significant uptick from the 4.9 per cent notched in the final three months of 2016, it represents a reduction from the 12.3 per cent expected at the start of this year.

The weaker estimates come at a time when stocks are trading near record highs. The S&P 500 has rallied by 6.2 per cent year-to-date as of Friday’s close — and the benchmark sits less than 1 per cent from the all-time peak it hit on March 1.

Equities look more expensive as a result. A closely watched valuation measure developed by Yale economist Robert Shiller, the cyclically adjusted price-to-earnings ratio, struck its highest point in 15 years this month.

Nicholas Colas, chief market strategist at Convergex, noted that it was a “normal pattern” for analysts to “start high with [earnings] estimates and move lower”, but he said this time should have been different given President Donald Trump’s slate of business-friendly initiatives.

“You wouldn’t know that there was an agenda in place to lower corporate taxes and raise infrastructure spending. That is invisible in the numbers,” he said.

Investors may have become too optimistic about the positive impact of Mr Trump’s fiscal policies, said Russ Koesterich, a portfolio manager at BlackRock.

In particular, he said that it is possible that the heated debate on Capitol Hill over healthcare reform will delay other measures, such as tweaks to the corporate tax code, that are expected to be a boon to companies’ bottom lines.

Beyond earnings, another cause for caution is that while data on the US economy have been “solid” overall, there are indications that growth may not “accelerate as quickly as people thought at the beginning of the year,” according to Mr Koesterich.

A running projection for first-quarter economic growth from the Atlanta Federal Reserve offers a prime example. It pegged the annualised rate of expansion at 3.4 per cent at the start of February on the back of strong data on manufacturing.

But the figure has consistently fallen, hitting 0.9 per cent after the jobs report on March 10 — a prediction that has held steady since then as further private and government economic reports have been released.

“We’re certainly in a better place than a year ago, but it’s not entirely obvious” that the pick-up will be as strong as investors had anticipated, Mr Koesterich said.